CA 541-T 2023-2026 free printable template

Show details

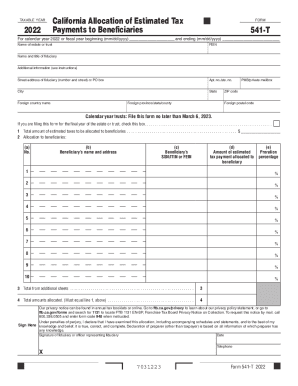

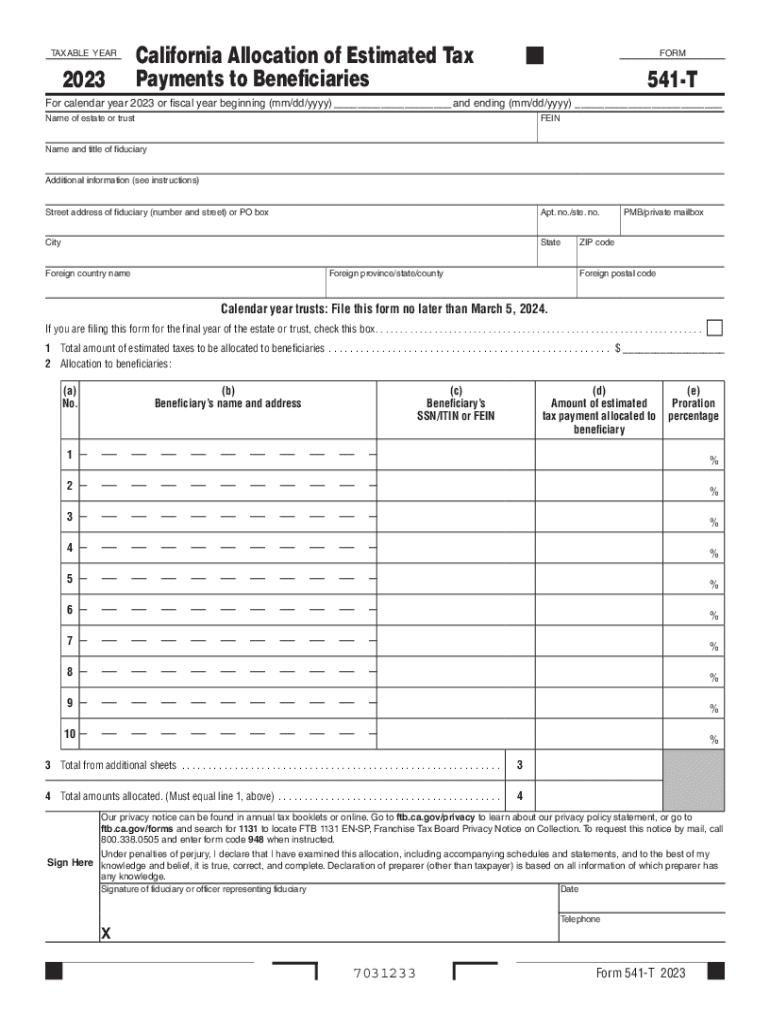

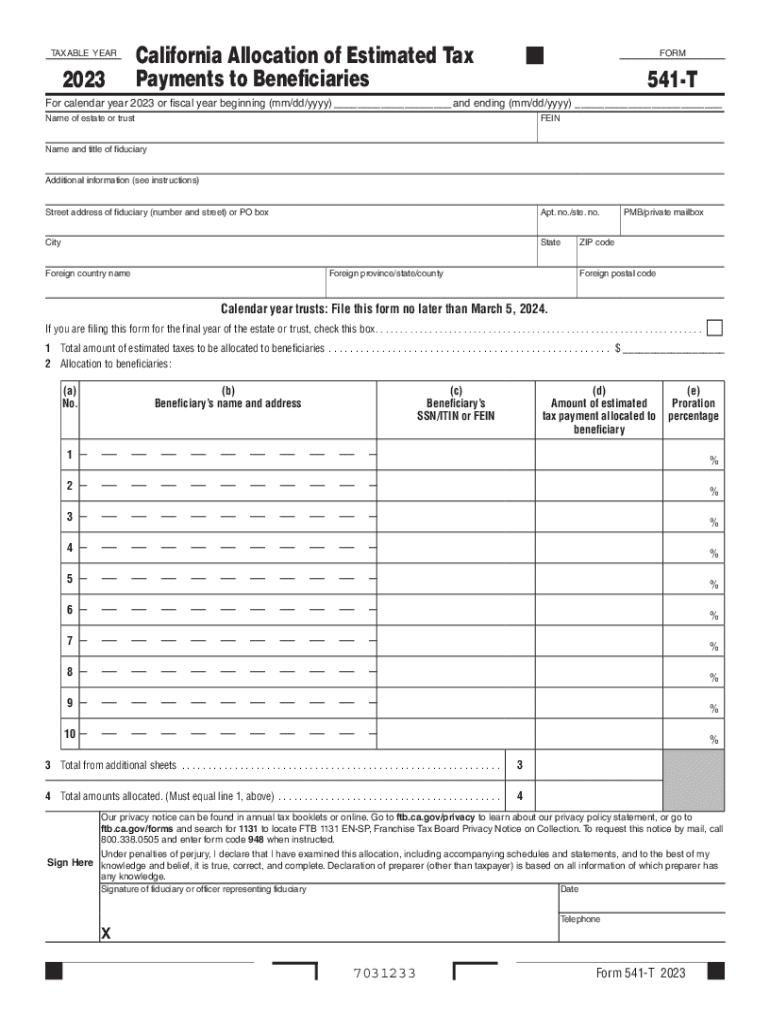

TAXABLE YEAR2023California Allocation of Estimated Tax

Payments to BeneficiariesFORM541TFor calendar year 2023 or fiscal year beginning (mm/dd/YYY) ___ and ending (mm/dd/YYY) ___

Name of estate or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 707168243 form

Edit your ca 541 allocation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2025 california estimated tax worksheet pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 541 estimated form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit allocation payments beneficiaries form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA 541-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 2025 form 541 es

How to fill out CA 541-T

01

Obtain the CA 541-T form from the California Department of Social Services website or your local county office.

02

Fill in the required information about the child and family, including names, addresses, and contact information.

03

Provide details regarding the child's qualifying relationship to the caregiver.

04

Indicate the type of assistance or support being requested.

05

Complete the financial information section, if required.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the form to the appropriate county welfare department.

Who needs CA 541-T?

01

Caregivers who provide care for a child and seek financial assistance through the California Department of Social Services.

02

Families looking to apply for services related to child welfare, such as foster care or adoption assistance.

Fill

california estimated tax worksheet

: Try Risk Free

People Also Ask about 2025 estimated tax worksheet

What is a Schedule D 541 in California?

Use Schedule D (541), Capital Gain or Loss, to report gains and losses from the sale or exchange of capital assets by an estate or trust. Generally, California law follows federal law.

What is a 541 tax form?

Taxpayers should not consider the tax booklets as authoritative law. A Purpose. Use Form 541-A, Trust Accumulation of Charitable Amounts, to report a charitable or other deduction under IRC Section 642(c). Split-interest trusts described in IRC Section 4947(a)(2) no longer have to file Form 541-A.

Who must file California Form 541?

The board states that when it comes time to allocate estimated tax payments to beneficiaries, the trust (or decedent's estate) must file the Form 541-T by the 65th day after the close of the current taxable year.

Who must file California form 541?

The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000. An alternative minimum tax liability.

What is the form 540 es?

Use Form 540-ES, Estimated Tax for Individuals, and the 2022 California Estimated Tax Worksheet, to determine if you owe estimated tax for 2022 and to figure the required amounts. Estimated tax is the tax you expect to owe in 2022 after subtracting the credits you plan to take and tax you expect to have withheld.

What is the form 541 es 2023?

Purpose. Use Form 541-ES, Estimated Tax For Fiduciaries, to figure and pay estimated tax for an estate or trust. Estimated tax is the amount of tax the fiduciary of an estate or trust expects to owe for the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in california quarterly tax payments without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your california estimated tax payments, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the worksheet a california tax electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your california estimated tax payment schedule 2025.

How do I edit ca quarterly tax payments on an Android device?

With the pdfFiller Android app, you can edit, sign, and share ca estimated tax on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is CA 541-T?

CA 541-T is a tax form used by the state of California for reporting transactions involving the sale of tangible personal property.

Who is required to file CA 541-T?

Individuals and businesses that sell tangible personal property in California and are required to report their sales tax transactions must file CA 541-T.

How to fill out CA 541-T?

To fill out CA 541-T, taxpayers need to provide their identifying information, details of sales transactions, and calculate the total sales tax collected for the reporting period.

What is the purpose of CA 541-T?

The purpose of CA 541-T is to facilitate the reporting of sales and use tax collected from customers in California, ensuring compliance with tax laws.

What information must be reported on CA 541-T?

CA 541-T requires reporting information including seller's details, total sales amount, total sales tax collected, and any deductions or exemptions applicable.

Fill out your CA 541-T online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimated Tax Worksheet 2025 is not the form you're looking for?Search for another form here.

Keywords relevant to ca form 541 instructions 2024

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.