CA 541-T 2002 free printable template

Show details

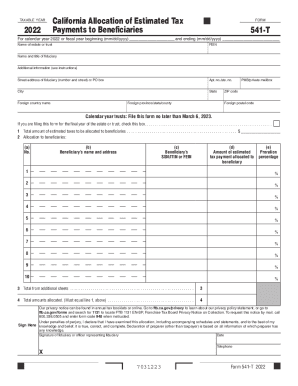

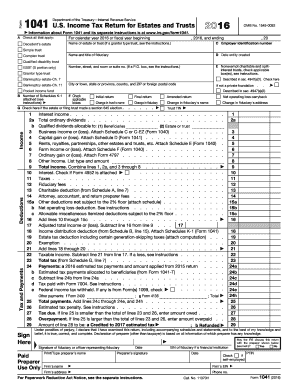

Print and Reset Form TAXABLE YEAR Reset Form 2002 Name of estate or trust California Allocation of Estimated Tax Payments to Beneficiaries VEIN 541-T For calendar year 2002 or fiscal year beginning

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california form 541 2002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california form 541 2002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california form 541 online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit franchise tax board form 541. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

CA 541-T Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california form 541 2002

How to fill out California form 541:

01

Gather all necessary information and documentation related to the decedent's estate, including their personal information, tax identification number, and details about the estate's assets and liabilities.

02

Begin by completing the "Identifying Information" section of the form, which includes the decedent's name, address, date of death, and tax identification number.

03

Provide details about the executor or administrator of the estate, including their name, address, contact information, and relationship to the decedent.

04

Proceed to the "Elections" section and indicate whether the estate will be subject to the small estate administration provisions or if an alternate valuation date will be elected for estate tax purposes.

05

Complete the "Income" section by reporting all taxable income earned by the estate since the decedent's date of death. This includes income from various sources such as rents, interest, dividends, and business activities.

06

Include information about deductions and exemptions in the "Deductions" section. This may include certain expenses related to the administration of the estate and allowable deductions for income tax purposes.

07

Calculate the estate's taxable income by subtracting the total deductions from the total income, and include the final figure in the "Tax Computation" section.

08

Provide details about any estimated tax payments made on behalf of the estate in the "Payments and Credits" section.

09

Calculate the final tax liability by subtracting the total credits from the tax computation amount, and include the result in the "Balance due with return" or "Overpayment" section, as applicable.

10

Sign and date the form, and include the executor's or administrator's name, address, and telephone number.

Who needs California form 541:

01

Individuals who have been appointed as the executor or administrator of a decedent's estate in California.

02

Those who are responsible for filing the final income tax return on behalf of the estate.

03

Executors or administrators who need to report and pay any income tax liability or claim a refund on behalf of the estate.

Fill form : Try Risk Free

People Also Ask about california form 541

What is a Schedule D 541 in California?

What is a 541 tax form?

Who must file California Form 541?

Who must file California form 541?

What is the form 540 es?

What is the form 541 es 2023?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california form 541?

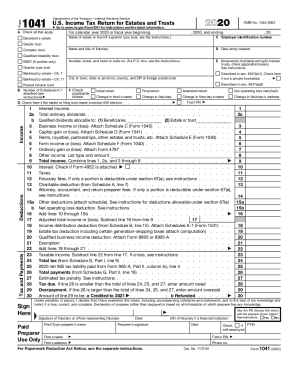

California Form 541 is the state's fiduciary income tax return for estates and trusts. This form is filed by estates and trusts that have generated income in California and need to report and pay taxes on that income. The form is used to calculate the taxable income, deductions, and any taxes owed by the estate or trust.

Who is required to file california form 541?

California Form 541, also known as the California Fiduciary Income Tax Return, must be filed by estates or trusts that have gross income of $10,000 or more during the tax year or are required to distribute income to beneficiaries. Filing this form is necessary to report and pay any California income tax owed by the estate or trust.

How to fill out california form 541?

To fill out California Form 541, which is the California Fiduciary Income Tax Return for estates and trusts, follow these steps:

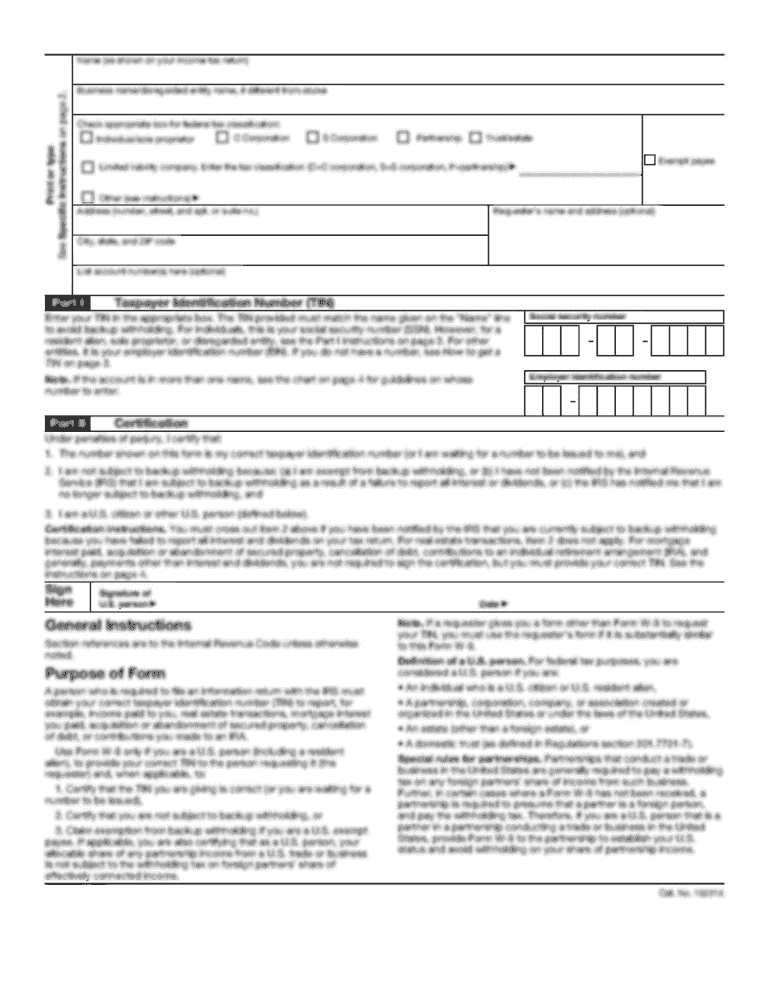

1. Gather all the necessary information and documents, including:

- Personal and contact information for the estate or trust

- Social Security number or taxpayer identification number for the estate or trust

- Income and expense statements for the estate or trust

- Schedule K-1s for beneficiaries, if applicable

- Documentation for deductions and credits claimed

2. Complete the top portion of the Form 541:

- Provide the estate or trust name, address, and taxpayer identification number

- Indicate if it's an initial, amended, or final return

- Enter the filing period dates

- Provide contact information for the person completing the return

3. Proceed with Part I, Income:

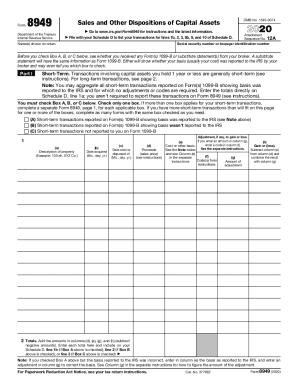

- Report all income generated by the estate or trust, including interest, dividends, rental income, capital gains/losses, and any other taxable income.

- Follow the instructions provided on the form for how to report each type of income.

- Attach Schedule D-1 if any capital gains or losses are applicable.

4. Move on to Part II, Deductions:

- Report deductible expenses related to the estate or trust, such as administration expenses, attorney fees, accounting fees, and other necessary costs.

- Follow the instructions on the form for how to report and calculate each deduction. Some deductions may require additional forms or documentation to be attached.

5. Next, complete Part III, Credits:

- Report any applicable credits, such as withholding credits or tax credits for solar, electric, or hybrid vehicles.

- Refer to the instructions on the form and attach any supporting documentation if required.

6. Proceed to Part IV, Tax Computation:

- Calculate the taxable income for the estate or trust by subtracting the total deductions and credits from the total income.

- Apply the appropriate tax rates provided in the instructions for the taxable income to determine the tax liability.

- Make sure to follow the specific instructions for calculating the tax liability based on the estate or trust type.

7. Complete Part V, Payments and Refundable Credits:

- Report any payments made throughout the year, including estimated tax payments and any taxes withheld.

- Calculate the total payments made and determine if there is an overpayment or an amount owed.

8. Fill out Part VI, Elections by Estate or Trust:

- Make any relevant elections or tax treatments based on the estate or trust's circumstances.

- Refer to the instructions for guidance on what elections are available and how to make them.

9. Review the completed form for accuracy, ensuring that all necessary schedules and attachments are included.

10. Sign and date the form, and provide any requested additional information or documentation.

11. Retain a copy of the completed Form 541 for your records, and submit the original to the appropriate California tax authority.

What is the purpose of california form 541?

The purpose of California Form 541, also known as the California Fiduciary Income Tax Return, is to report the income, deductions, and taxes for estates and trusts in the state of California. It is used to calculate and pay the income tax owed by the estate or trust. This form is filed by fiduciaries, who are responsible for managing and distributing the income of the estate or trust to the beneficiaries.

What information must be reported on california form 541?

California Form 541, also known as the California Fiduciary Income Tax Return, is used to report income and deductions for an estate or trust. The following information must be reported on Form 541:

1. Identifying Information: The name, address, and taxpayer identification number (TIN) of the estate or trust must be provided, along with the name and contact information of the fiduciary (person responsible for managing the estate or trust).

2. Income: All income received by the estate or trust during the tax year must be reported. This includes interest, dividends, rental income, capital gains, and other sources of income.

3. Deductions: Allowable deductions, such as administrative expenses, legal and accounting fees, trustee commissions, and other expenses incurred in the administration of the estate or trust, must be reported.

4. California Adjustments: Certain adjustments may be required to reconcile California taxable income with federal taxable income. This may include differences in treatment of income or expenses under California law compared to federal law.

5. Tax Computation: The tax liability for the estate or trust is calculated based on the taxable income, deductions, and California tax rates.

6. Tax Payments and Credits: Any estimated tax payments made throughout the year, withholding taxes, and any applicable credits must be reported.

7. Beneficiary Information: Information about the beneficiaries, including their names, addresses, and TINs, may need to be provided.

It is important to consult the instructions for Form 541 and seek professional advice if needed to ensure accurate reporting on the form.

When is the deadline to file california form 541 in 2023?

The deadline to file California Form 541 (California Fiduciary Income Tax Return) in 2023 is April 18th, 2023. However, please note that tax deadlines are subject to change, so it is advisable to double-check with the California Franchise Tax Board or a qualified tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of california form 541?

The penalty for the late filing of California Form 541, which is the California Fiduciary Income Tax Return, can vary depending on the circumstances. As of my knowledge cutoff in September 2021, the penalty for filing the form late is typically calculated as a percentage of the unpaid tax due.

For instance, if the return is filed more than 60 days late, the penalty can be calculated as 5% of the unpaid tax due, plus an additional 0.5% for each additional month the return is late, up to a maximum penalty of 25% of the unpaid tax due.

It is important to note that these penalties are subject to change, so it is always advisable to consult the most up-to-date information from the California Franchise Tax Board or a qualified tax professional.

How do I make edits in california form 541 without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing franchise tax board form 541 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the california franchise tax board form 541 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form 541 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit franchise tax board form 541 fillable on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share franchise tax board fillable form 541 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your california form 541 2002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Franchise Tax Board Form 541 is not the form you're looking for?Search for another form here.

Keywords relevant to california form 541 instructions

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.